Millennial Parents Struggle with High Cost of Living

Better money management today can lead to brighter financial future

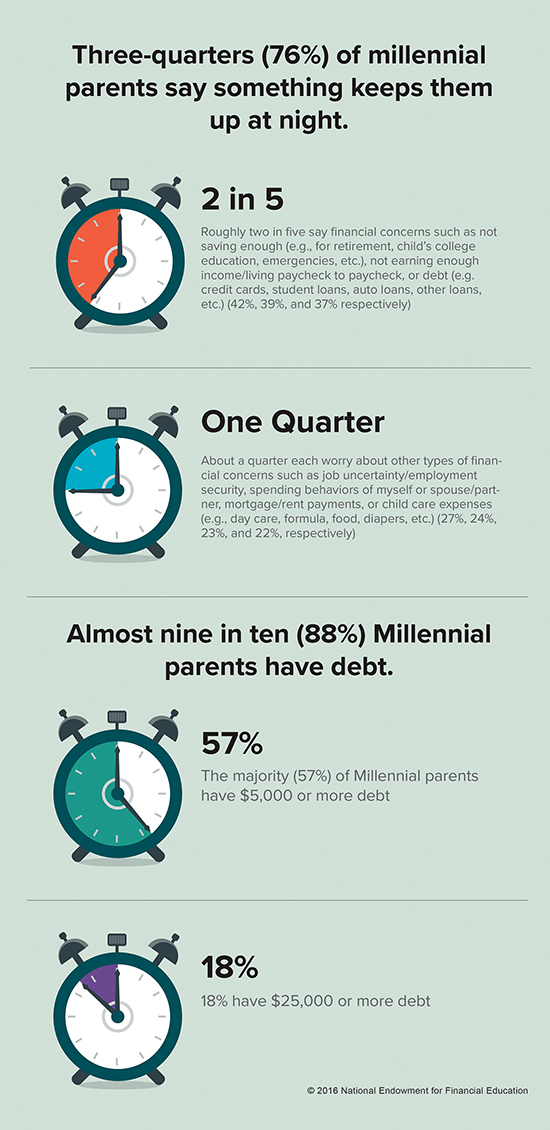

For many young adults, heavy debt and lower-paying jobs lead to a delay in traditional life goals like buying homes and starting families. However, research suggests that millennials’ financial worries are adding up to more than stress and disappointment, particularly once they become parents.

Two in five young parents rate their financial health as unsatisfactory and 40 percent said financial stress is putting a strain on their relationship, according to a survey from the National Endowment for Financial Education and Parents Magazine. More than half of millennial parents concede they would surrender a year of their life to have more financial security.

“Being a parent takes patience, forgiveness and a lot of silent counts to 10, but it also takes a lot of money,” said Paul Golden, director of Smart About Money, a nonprofit foundation inspiring educated financial decision-making for individuals and families through every stage of life. “Many young adults start off with significant student loan debt. When you add housing, groceries, utilities, transportation expenses and health care costs, the strain increases, and oftentimes the math in the household budget doesn’t add up.”

The price tag of raising a child is more than $304,000 based on the projected inflation-adjusted cost of rearing a child until age 18, not counting college. Managing that financial pressure begins with planning for the future and truly understanding the costs associated with adding a baby to the family or buying a new home, Golden added.

“Regularly paying attention to your money and practicing major life transitions before they happen is an important step toward achieving financial health,” he said.

As a parent, you have many financial responsibilities to balance, but planning for the future can help prevent unforeseen expenses from tipping your scales.

Debt reduction. Make a plan to pay off excessive debt, particularly credit cards. Tackle your lowest balance first to gain momentum then take on the next smallest. Additionally, pay attention to higher interest rates that are costing you a lot of money.

Use a budget. Get a budget and spending plan in place to keep track of your expenses. Try an envelope system with monthly allowances for groceries, entertainment, utilities, etc.

Start saving. Build an emergency fund. Aim for a small, achievable goal as low as $500 then set the bar higher. Participate in your employer-sponsored savings program to boost retirement savings, especially if there is a match. Make it an automatic payroll deduction and increase it when your paycheck goes up. As far as your child’s college savings, save what you can, when you can. Every little bit will help when education bills come due.

Child care. Consider establishing a flexible spending account if one is offered by your employer. Parents can use pretax dollars to pay up to $5,000 in child care expenses in most states.

Review insurance and important paperwork. Create a will either by using an online program or hiring a professional to name your child’s guardian, and designate at what age any payouts, savings or investments will be distributed. With health insurance, notify your employer within 30 days of the birth to ensure that the child is eligible for any dependent benefits. Purchase appropriate health care coverage to protect your family. Review your employer’s life insurance plan and determine if it is adequate for your needs. If not, consider purchasing additional life insurance.

Save for the future. Put money for short-term expenses (1-5 years) in safe investments, such as savings accounts and certificates of deposit. These low-interest-rate investments will not grow dramatically, but they will not lose money, either. Money you will need beyond five years should have the opportunity to grow at a risk level you are comfortable with. Use a combination of steady-earning savings accounts and more volatile stock and bond mutual funds to help protect you against long-term losses.

Get started with these tips and learn more through self-directed courses at SmartAboutMoney.org.

How Much Does Having a Baby Cost?

Along with preparing for the costs of clothes, furniture and baby items, take time to review your health care and employer benefits and policies relating to time off work.

Spread the costs.

Compile a list and calculate the total of anticipated expenses, including doctor fees, maternity clothes, birthing classes, unpaid time off for maternity leave and necessities for the baby. Distribute the total cost throughout the duration of your pregnancy. If you pay as you go rather than purchase everything at once, the sum becomes easier to manage.

Know what’s covered.

Health care plans vary widely and while a friend may have had all the expenses paid for, not all insurance plans are alike. Know what you will be responsible for and when payments are due. Ask about co-pays, co-insurance, deductibles, out-of-pocket costs, birthing and other classes, and specialty tests. Discuss how costs change if you require a C-section or any other additional hospitalization.

Account for time off work.

Look into maternity and paternity leave, and learn about additional unpaid time off under the Family and Medical Leave Act. Be aware that if your company has fewer than 50 employees, it’s not required to offer FMLA leave. Ask your employer if you can use unused sick and vacation days to cover your maternity leave. Don’t forget to calculate any lost pay if you’ll need unpaid time off for doctor’s appointments.

Source:

National Endowment for Financial Education

Save

Save

Save

Save

Save